are new hampshire property taxes high

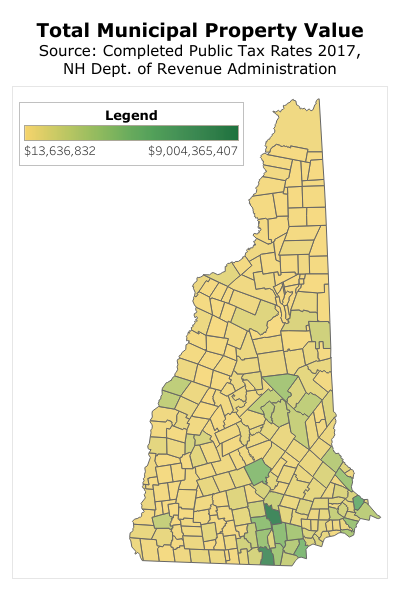

The result is that New Hampshire charges an average property tax rate of 205. In Claremont for example the property tax rate is 41 per 1000 of assessed value while in Auburn its only around 21 per 1000 of assessed value.

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

No income tax No sales tax No capital gains tax No inheritance or estate taxes New Hampshire does collect.

. Property tax rates the other New England states were. The citizens of New Hampshire pay a higher percentage of income in. 7202018 43800 PM New Hampshire has the second-highest property taxes per capita in the nation behind New Jersey.

According to findings released by financial website WalletHub the state has a 218 tax rate with consumers paying 5701 in real estate taxes on a home with a 261700 median value. Average Effective Property Tax Rate. New Hampshire is also third highestwhen the state median home value is considered.

The breakdown between the counties in the state is as follows. Why such a wide range. New Hampshire does not impose income tax on your earnings from your job but you are taxed for investments.

Ad Our Search Covers City County State Property Records. Connecticut is second with a 5746 average tax bill on a home worth 272700. Ad Reduce property taxes for yourself or residential commercial businesses for commissions.

Find Out Whats Available. Which NH towns have the highest property taxes. New Hampshires median home value of 252800 is the 12th highest in the country and the property taxes on that are a median of about 5550.

New Jersey also ranks first again with a 8104 tax bill on a home priced at 327900. WalletHub Analyst Liz Gonzalez said states with exceptionally high property taxes normally dont force different kinds of assessments for example deals. However since there are no income or sales taxes the total tax bite is low.

Look Up Any Address in New Hampshire for a Records Report. Does New Hampshire have property tax. Median Annual Property Tax.

What is a personal note in real estate. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. This is followed by Berlin with the second highest property tax rate in New Hampshire with a property tax rate of 3654 followed by Gorham with a property tax rate of 356.

Reduce property taxes for yourself or others as a legitimate home business. As indicated by findings. The Center Square A new study shows New Hampshire ranks third highest in the country for high property taxes.

When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of January 1 2022. There use to be a saying that Welfare in NH was a bus ticket to Mass. Yes they do and it is considered high at 2 of assessed value per year.

Connecticut with a 21 rate is almost as high as New Hampshire. Maine 14 and Massachusetts 12. Claremont 4098 Berlin 3654 Gorham 3560 Northumberland 3531 Newport 3300 Which NH towns have the lowest property taxes.

Property tax rates vary widely across New Hampshire which can be confusing to house hunters. Another study shows New Hampshire positions third most elevated in the country for the high property taxes. August 3 2018 Mark Fernald 0 New Hampshire has the second-highest property taxes per capita in the nation.

The citizens of New Hampshire pay a higher percentage of income in property tax 56 percent than any other state. See Results in Minutes. Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions.

I always tell people that NH is not a good place if you need a lot of government support. Any profit from interest and dividends in New Hampshire comes along with a 5 tax rate. Of course New Hampshires property tax rate is high and averages 220 but that is their only high tax rate.

The Center Square A new study shows New Hampshire ranks third highest in the country for high property taxes. The myth in New Hampshire is that we run the state on sin taxes cigarettes alcohol and gambling.

Lowering New Hampshire Property Taxes Challenging Assessment Value

Understanding New Hampshire Taxes Free State Project

9 States Without An Income Tax Income Tax Income Tax

New Hampshire Retirement Tax Friendliness Smartasset

What You Should Know About Moving To Nh From Ma

New Hampshire Income Tax Calculator Smartasset

.JPG)

Nh Low Tax Towns L Nh Lakefront Property L Luxury To Affordable

New Hampshire Property Tax Calculator Smartasset

Historical Houses Of Keene Cheshire County Nh

Property Tax Information Town Of Exeter New Hampshire Official Website

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Understanding New Hampshire Taxes Free State Project

Best Homeowners Insurance In New Hampshire 2022 Forbes Advisor

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Boston Property Tax How Does It Compare To Other Major Cities

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)